EEM and FHA 203k: How to Combine Renovation and Energy Efficiency in One Mortgage

Most renovation loans focus on what buyers can see—new kitchens, bathrooms, flooring, or additions. Energy financing, on the other hand, focuses on what buyers feel—lower utility bills, better comfort, and long-term savings.

What many buyers don’t realize is that these two strategies can work together.

By combining an Energy Efficient Mortgage (EEM) with an FHA 203k loan, buyers unlock one of the most powerful—and least talked about—financing options available today.

What Is the EEM + FHA 203k Combination?

The EEM and FHA 203k pairing allows borrowers to finance:

Visible renovations (repairs, updates, structural work)

Invisible efficiency upgrades (energy-saving improvements)

…all within one FHA-insured mortgage.

The FHA 203k covers the renovation scope, while the FHA 203k energy efficient mortgage feature allows approved energy improvements to be included—often with minimal impact on monthly payments.

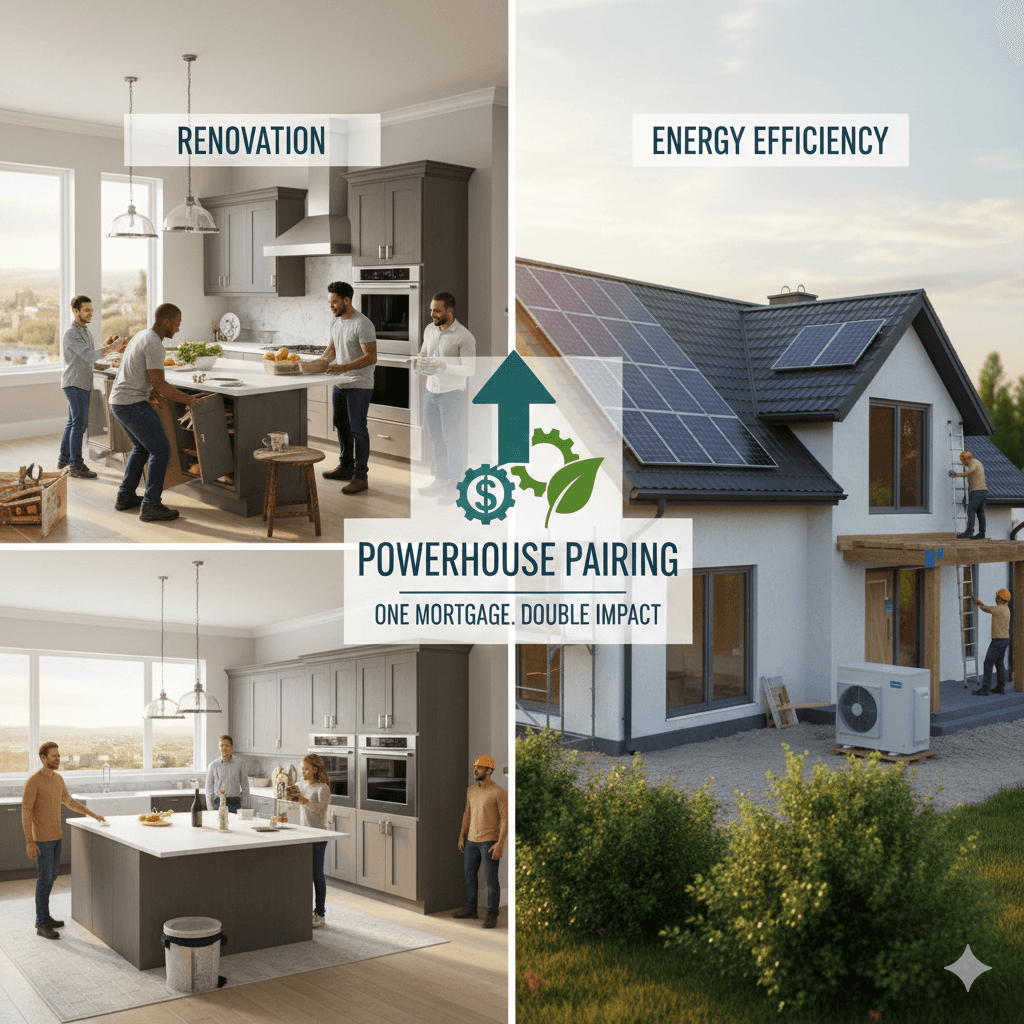

Why This Is a “Powerhouse Pairing”

Most homes—especially older properties—need both cosmetic updates and efficiency improvements. Separately, these upgrades are often financed with different loans or delayed altogether.

Together, this renovation and energy efficiency loan strategy allows buyers to:

Renovate once, not twice

Finance upgrades at mortgage interest rates

Improve comfort and performance immediately

Lower long-term operating costs

It’s a smarter way to renovate from the start.

What the FHA 203k Covers?

An FHA 203k loan can finance a wide range of renovations, including:

Kitchen and bathroom remodels

Flooring, paint, and finishes

Structural repairs and additions

Roofing, plumbing, electrical, and HVAC upgrades

Safety and code compliance work

This is the “visible” side of the renovation.

What the EEM Adds to the Renovation

The Energy Efficient Mortgage component focuses on performance upgrades that buyers often postpone.

Common EEM-funded improvements include:

Insulation and air sealing

High-efficiency HVAC systems

Energy-efficient windows and doors

Water-heating improvements

Renewable or smart energy features

Together, this creates a true green rehab loan—one that improves both livability and affordability.

Why Buyers Usually Miss This Option

This combination is rarely discussed because it sits at the intersection of renovation lending and energy efficiency—two areas that are often handled separately.

Buyers miss out because:

EEMs are misunderstood

Renovation loans feel complex

Energy efficiency isn’t prioritized during underwriting

With proper guidance, this pairing becomes a strategic advantage.

The Long-Term Benefits of Combining Renovation + Efficiency

Buyers who use an EEM + FHA 203k strategy often see:

Lower monthly utility bills

Improved comfort and indoor air quality

Stronger affordability over time

Increased resale appeal

One coordinated renovation timeline

Instead of upgrading in phases, buyers build smarter from day one.

Why Education and Planning Matter

Combining an EEM with an FHA 203k requires planning, documentation, and coordination. When done correctly, it maximizes value. When done poorly—or skipped entirely—buyers lose out on benefits they can’t easily add later.

This is where professional guidance changes outcomes.

Thinking about renovating?

Don’t just upgrade what you can see—upgrade what you pay for every month.

Let’s build a smarter, more efficient plan that combines renovation and energy efficiency into one powerful financing strategy.

If you’d like to learn more, click the link below for more information.

HEY, I'M WALTER L. WILLIAMS

Walter L. Williams was born and raised in the City of Detroit. He has two associate degrees, one in Applied Science Architectural Building Construction Technology from Schoolcraft Collage and an Associate of Arts in Liberal Arts from Henry Ford Collage.

Walter has been in the Building Services business for over 30 years as an Architectural Draftsperson working for Detroit Water and Sewerage, City Engineering Department and his current companies, People, Places & Things LLC, Residential Design and Space Planning, PPT Inspections, Home and Building Inspections, My Rehab Consultant, FHA HUD 203K Consultant and one of the founders of New Decade - New Home Educational.

Home Buyers University: Start Here

Embark on your homeownership journey with New Decade - New Home, a comprehensive program providing valuable insights and education for first-time buyers, those seeking to upsize, or those aiming to create generational wealth through property investment.

Upcoming Events

Online Webinars (1 hour):

January 22, 2026

Workshops (3 - 4 Hours):

January 28, 2026 - ConED Course (3-hour course on FHA 203(k) Renovation Mortgages: Unlocking Potential for Real Estate Agents

Lunch and Learn Event:

February 6, 2026 at The Java House: How to Managing Multiple Business.

Workshops (3 - 4 Hours):

February 28, 2026 (Realtors 201 - 2 - 3-hour event) at Our Gathering Place in Detroit, MI (Title Connect) is our partner on this one.

Contact Us

Phone: 313-799-3760

Email: seminar@newdecadenewhome.com

© New Decade New Home