How a HERS Energy Audit Works for an Energy Efficient Mortgage (EEM Explained)

If you’re considering an Energy Efficient Mortgage (EEM), you’ll likely hear about something called a HERS energy audit. For many buyers, this is the most confusing part of the process.

What exactly is it? Who performs it? And how does it impact loan approval?

The good news: the EEM energy assessment isn’t complicated once you understand how it works—and it’s designed to protect you.

What Is a HERS Energy Audit?

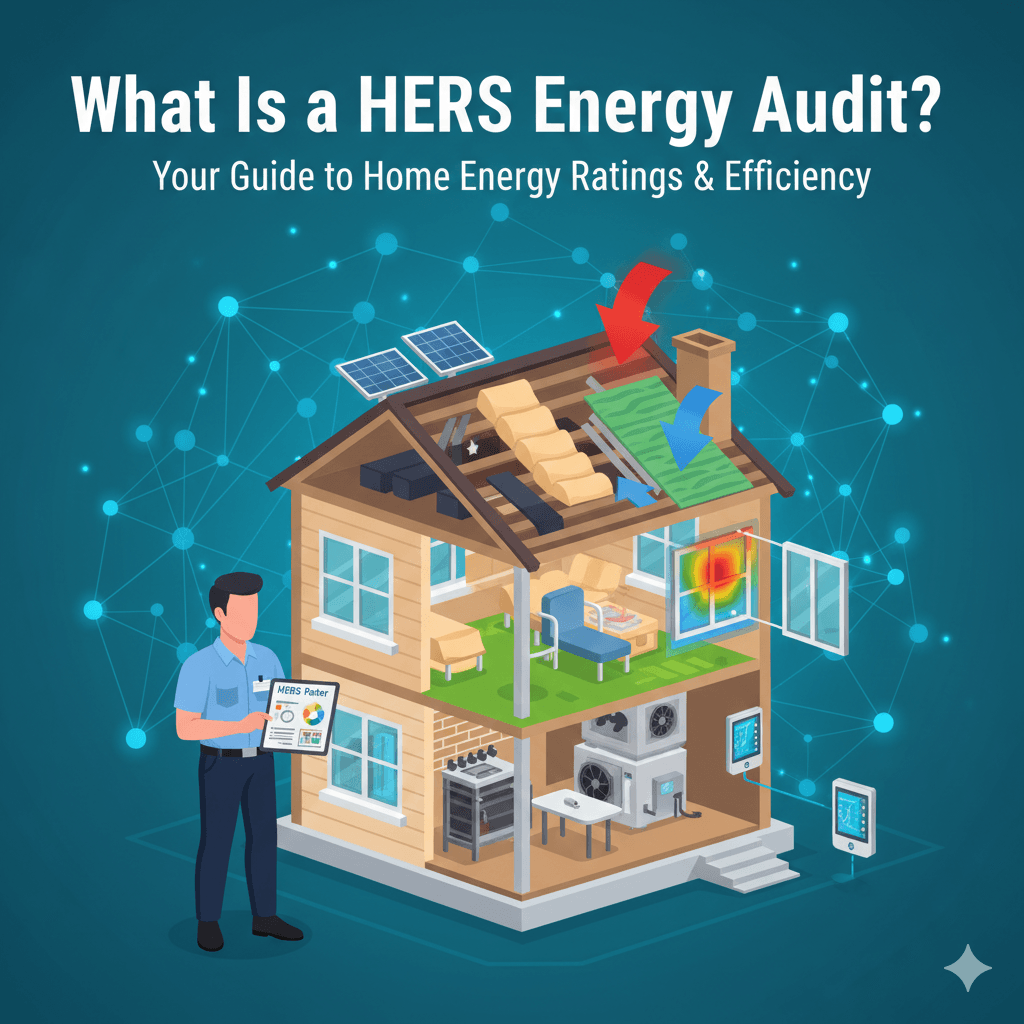

A HERS energy audit (Home Energy Rating System audit) is a professional evaluation of a home’s energy performance.

A certified HERS rater examines:

Insulation levels

Heating and cooling systems

Windows and doors

Air leakage

Water heating systems

Overall energy usage

The goal is to measure how efficient a home currently is—and how much more efficient it could become with upgrades.

What Is the Home Energy Rating System?

The Home Energy Rating System (HERS) is a nationally recognized scoring system that assigns a numerical rating to a home’s energy performance.

Lower scores = more energy efficient

Higher scores = less efficient

A new, high-performance home may score near 0.

An older, inefficient home may score well above 100.

The HERS score provides a standardized way for lenders to validate projected energy savings.

How the EEM Energy Assessment Works Step-by-Step

Here’s how the energy audit mortgage process typically works within an EEM:

1. Initial Property Evaluation

A certified energy rater inspects the home and gathers performance data.

2. Energy Modeling

Software models projected savings from proposed improvements (e.g., HVAC upgrades, insulation, windows).

3. Cost vs. Savings Calculation

The rater determines:

Estimated cost of upgrades

Projected annual energy savings

Payback timeline

4. Lender Review

The lender uses this documentation to approve eligible improvements under the Energy Efficient Mortgage.

How Savings Are Validated and Approved

This is where the HERS audit becomes powerful.

Lenders need proof that upgrades are:

Cost-effective

Energy-saving

Justifiable within underwriting guidelines

The audit provides documented projections showing that the monthly energy savings help offset the cost of financing improvements.

This validation allows buyers to include upgrades in their mortgage responsibly.

Why the HERS Audit Protects You

Some buyers worry the audit is just another step—but it actually serves as protection.

It ensures:

You’re not overspending on low-impact upgrades

Improvements deliver measurable value

Financing decisions are data-driven

The mortgage remains affordable

The audit adds structure and accountability to the process.

Common Improvements Identified in a HERS Audit

The EEM energy assessment often highlights:

Inefficient HVAC systems

Poor attic insulation

Air leaks around doors and windows

Aging water heaters

High energy loss areas

Many buyers are surprised to learn how small adjustments can produce meaningful savings.

Why This Matters in Today’s Market

With rising utility costs and tighter affordability, energy performance plays a bigger role than ever. The HERS audit transforms efficiency from a guess into a measurable financial strategy.

Instead of hoping upgrades save money—you’ll know.

Curious what an energy audit would reveal about your home?

You may be sitting on savings you haven’t discovered yet.

Let’s talk about how a HERS energy audit fits into your Energy Efficient Mortgage strategy.

If you’d like to learn more, click the link below for more information.

HEY, I'M WALTER L. WILLIAMS

Walter L. Williams was born and raised in the City of Detroit. He has two associate degrees, one in Applied Science Architectural Building Construction Technology from Schoolcraft Collage and an Associate of Arts in Liberal Arts from Henry Ford Collage.

Walter has been in the Building Services business for over 30 years as an Architectural Draftsperson working for Detroit Water and Sewerage, City Engineering Department and his current companies, People, Places & Things LLC, Residential Design and Space Planning, PPT Inspections, Home and Building Inspections, My Rehab Consultant, FHA HUD 203K Consultant and one of the founders of New Decade - New Home Educational.

Home Buyers University: Start Here

Embark on your homeownership journey with New Decade - New Home, a comprehensive program providing valuable insights and education for first-time buyers, those seeking to upsize, or those aiming to create generational wealth through property investment.

Upcoming Events

Online Webinars (1 hour):

January 22, 2026

Workshops (3 - 4 Hours):

January 28, 2026 - ConED Course (3-hour course on FHA 203(k) Renovation Mortgages: Unlocking Potential for Real Estate Agents

Lunch and Learn Event:

February 6, 2026 at The Java House: How to Managing Multiple Business.

Workshops (3 - 4 Hours):

February 28, 2026 (Realtors 201 - 2 - 3-hour event) at Our Gathering Place in Detroit, MI (Title Connect) is our partner on this one.

Contact Us

Phone: 313-799-3760

Email: seminar@newdecadenewhome.com

© New Decade New Home