Understanding the FHA 203k Loan: A Beginner’s Guide to Renovation Financing

Buying a home in today’s real estate market can be overwhelming—especially when you find a property with great potential but in need of updating or repairs. Many buyers walk away from “fixer-upper” homes, worried about the cost, the time, and the complexity of renovations.

But what if you could buy the home and fund the repairs with just one mortgage?

This is exactly what the FHA 203k Rehabilitation Mortgage is designed to do. As part of our educational series at New Decade – New Home, this guide will walk you through what the 203k loan is, how it works, and who plays a role in making it all happen.

What Is an FHA 203k Loan?

An FHA 203k loan is a government-backed mortgage that allows homebuyers or homeowners to finance both the purchase (or refinance) of a home AND the cost of repairs or improvements through a single loan.

Instead of applying for multiple loans—one for buying the home, another for renovations, and possibly another permanent mortgage—203k financing makes it simple and streamlined.

It is especially helpful for:

First-time homebuyers

Buyers purchasing older or distressed properties

Homeowners refinancing to make improvements

Anyone planning renovations but wanting one consolidated mortgage payment

With a 203k loan, you can modernize a property, fix safety issues, complete repairs, or even perform major remodeling—all while wrapping the costs into your home financing.

Why 203k Loans Matter in Today’s Market?

Many traditional mortgage programs require homes to be in good condition before closing. This leaves buyers unable to purchase properties that need even minor repairs.

The 203k program solves this by allowing:

Repairs to be funded after closing

FHA minimum property standards to be met through the renovation

Buyers to build instant equity by improving their home

In a real estate landscape where move-in-ready homes are competitive and often expensive, the 203k program opens doors—literally and figuratively—to more affordable homeownership.

The Key Players in the FHA 203k Process

1. The Borrower

This is the homeowner or homebuyer. Their role is to:

Choose the property

Select desired repairs or upgrades

Work with the FHA Consultant and contractor

Understand the budget and timeline

It’s important for borrowers to have realistic expectations—renovations can be rewarding but require coordination and patience.

2. The Real Estate Agent

A knowledgeable agent is essential. They help:

Identify properties that qualify

Advise on offer strategies

Coordinate with lenders and consultants

Educate buyers on 203k opportunities

Agents who understand 203k loans can help clients see the potential in homes others might skip over.

3. The FHA 203k Consultant

This is one of the most important professionals in the process.

The consultant:

Evaluates the home

Identifies necessary repairs

Helps the borrower choose improvements

Prepares a detailed Work Write-Up (scope of work)

Reviews contractor bids

Performs draw inspections during construction

Think of the consultant as the project navigator, ensuring everything meets FHA standards and stays on track.

4. The Contractor

A licensed contractor performs the actual renovation work. Their responsibilities include:

Providing accurate bids

Completing work per FHA guidelines

Meeting timeline expectations

Requesting funds through draw inspections

Choosing the right contractor can make or break a renovation—experience with 203k projects is a big plus.

5. The Lender

The lender manages the financial side. Their role includes:

Qualifying the borrower

Approving the consultant’s work plan

Holding renovation funds in escrow

Releasing payments as work is completed

They ensure that both the purchase and renovation financing move smoothly from start to finish.

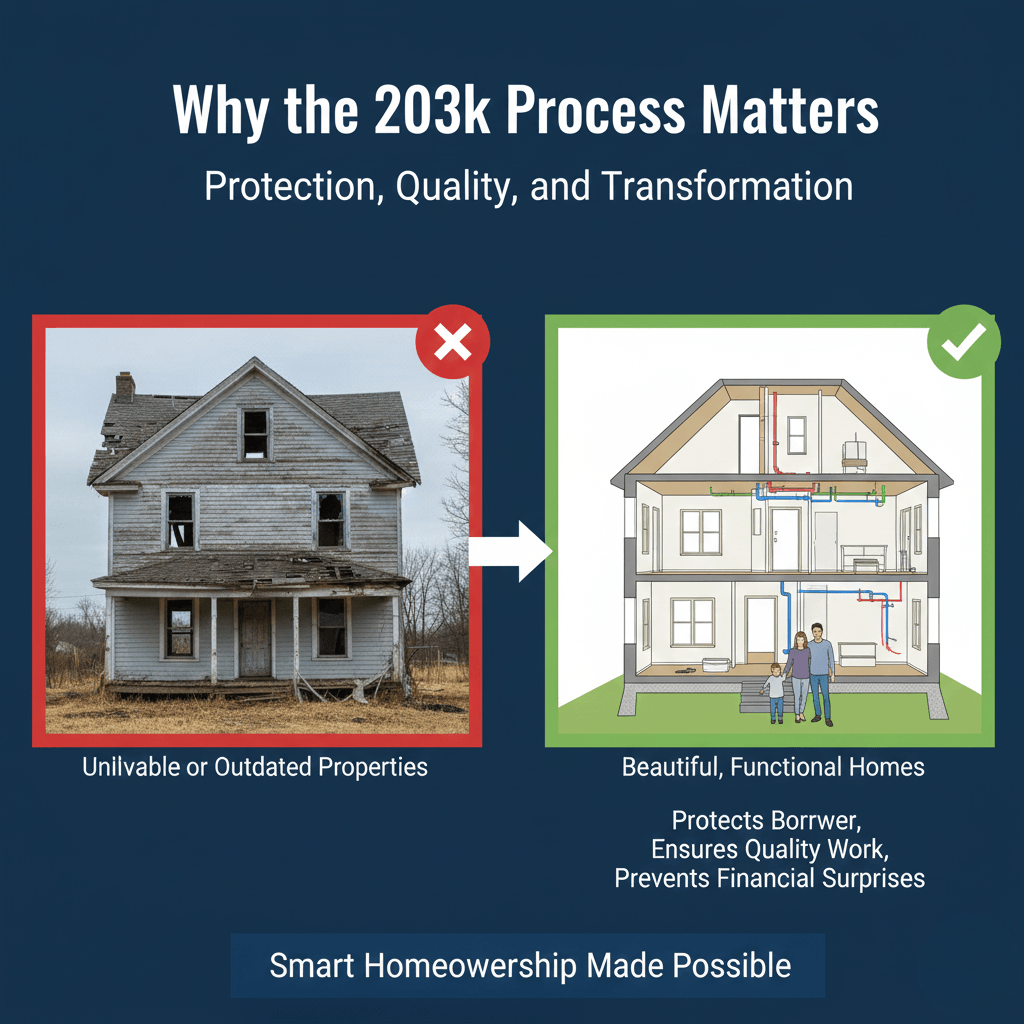

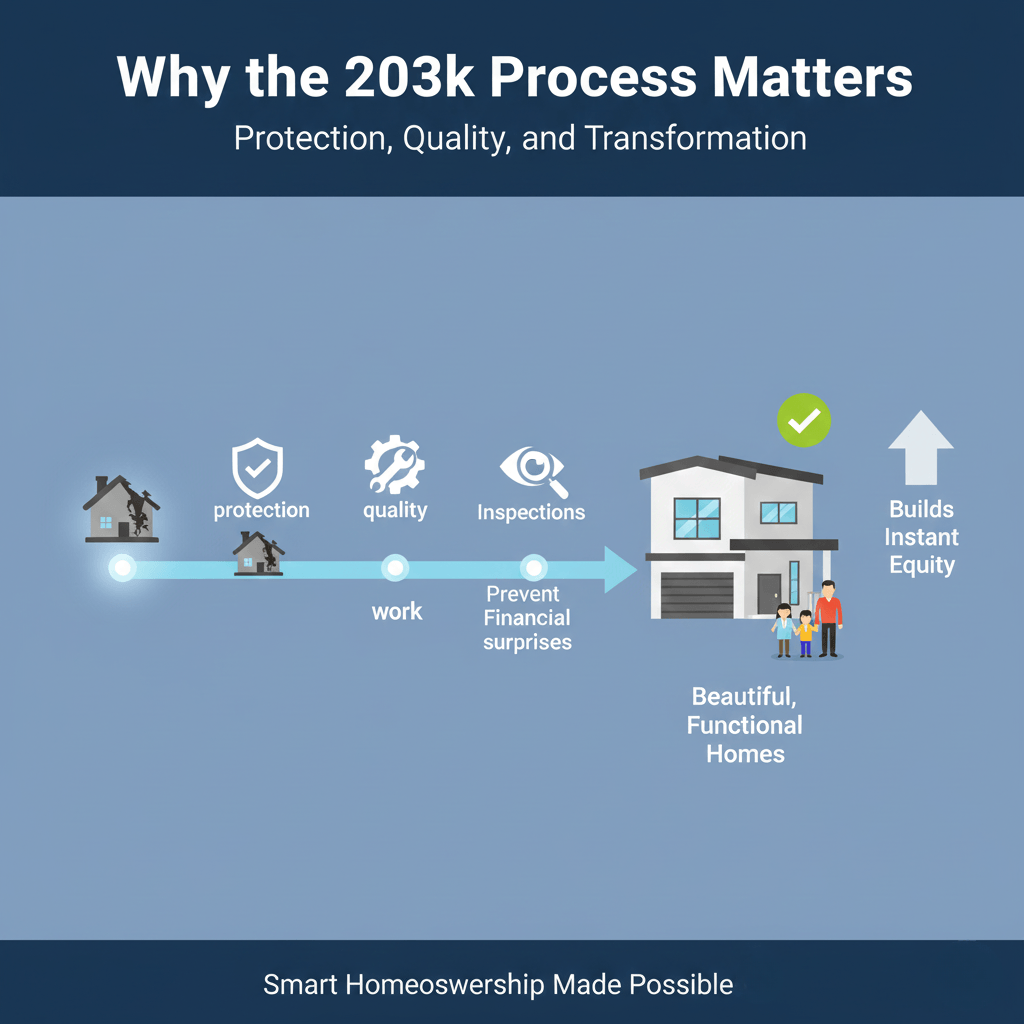

Why the 203k Process Matters?

The 203k process is structured to protect everyone involved—especially the borrower. With checks and balances, inspections, and guidelines, the system is designed to ensure quality work and prevent financial surprises.

It turns properties that may seem unlivable or outdated into beautiful, functional homes—often at a fraction of the cost of buying a fully renovated home.

Is a 203k Loan Right for You?

Consider an FHA 203k loan if you:

Want to personalize or upgrade your new home

Are open to buying a fixer-upper

Need repairs completed to meet FHA standards

Want to roll renovation costs into your mortgage

Whether it’s modernizing a kitchen, replacing roofing, improving energy efficiency, or repairing structural issues, 203k financing provides flexibility and opportunity.

Final Thoughts: A New Home for the New Decade

At New Decade – New Home, we believe in empowering buyers and homeowners with the knowledge they need to make smart real estate decisions. The FHA 203k program is a powerful financial tool—and with the right team, it can turn your vision into reality.

If you're considering purchasing or renovating a home this year, understanding 203k financing is a great first step.

Want to dive deeper into 203k Rehab Loans? Let’s learn together!

We invite you to our FREE Holiday Lunch & Learn, where you’ll receive real-world guidance on using rehab loans to grow and streamline your business.

Seats fill quickly — registration is a must.

HEY, I'M WALTER L. WILLIAMS

Walter L. Williams was born and raised in the City of Detroit. He has two associate degrees, one in Applied Science Architectural Building Construction Technology from Schoolcraft Collage and an Associate of Arts in Liberal Arts from Henry Ford Collage.

Walter has been in the Building Services business for over 30 years as an Architectural Draftsperson working for Detroit Water and Sewerage, City Engineering Department and his current companies, People, Places & Things LLC, Residential Design and Space Planning, PPT Inspections, Home and Building Inspections, My Rehab Consultant, FHA HUD 203K Consultant and one of the founders of New Decade - New Home Educational.

Home Buyers University: Start Here

Embark on your homeownership journey with New Decade - New Home, a comprehensive program providing valuable insights and education for first-time buyers, those seeking to upsize, or those aiming to create generational wealth through property investment.

Upcoming Events

Online Webinars (1 hour):

January 22, 2026

Workshops (3 - 4 Hours):

January 28, 2026 - ConED Course (3-hour course on FHA 203(k) Renovation Mortgages: Unlocking Potential for Real Estate Agents

Lunch and Learn Event:

February 6, 2026 at The Java House: How to Managing Multiple Business.

Workshops (3 - 4 Hours):

February 28, 2026 (Realtors 201 - 2 - 3-hour event) at Our Gathering Place in Detroit, MI (Title Connect) is our partner on this one.

Contact Us

Phone: 313-799-3760

Email: seminar@newdecadenewhome.com

© New Decade New Home